1,000 signatures reached

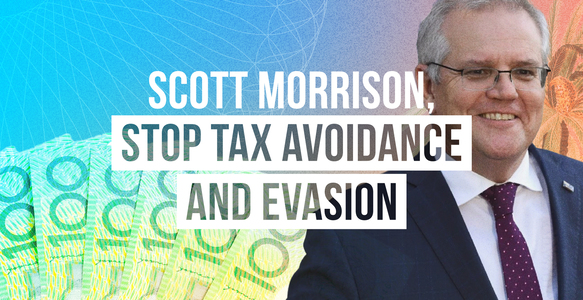

To: Scott Morrison

Tax avoidance and evasion costs Australia $50 billion each year

This campaign has ended.

The Morrison Government promised in 2018 to crack down on tax evasion by big business and mega-millionaires, but has done nothing.

Now, the Pandora Papers have exposed how politicians, billionaires and celebrities avoid and evade tax. More than 400 mega-wealthy Australians were named in the Papers.

Everyday Australians can’t afford expensive accountants to use legal trickery to minimise their tax. When the mega-wealthy use these loopholes to lower how much tax they pay, it is always at the expense of everyone else who make up the vast majority of taxpayers.

The Morrison Government has failed for four years to close these loopholes and stop the ultra-rich from avoiding tax.

Now, the Pandora Papers have exposed how politicians, billionaires and celebrities avoid and evade tax. More than 400 mega-wealthy Australians were named in the Papers.

Everyday Australians can’t afford expensive accountants to use legal trickery to minimise their tax. When the mega-wealthy use these loopholes to lower how much tax they pay, it is always at the expense of everyone else who make up the vast majority of taxpayers.

The Morrison Government has failed for four years to close these loopholes and stop the ultra-rich from avoiding tax.

Why is this important?

The mega-wealthy should pay the same average rates of tax as everyday Australians, but the Morrison Government has failed to change bad laws that offer incentives and loopholes for mega-millionaires to reduce their tax to less than the average rates.

The end result is that when mega-millionaires and billionaires use these tax loopholes, it costs billions of dollars each year.

Tax avoidance is not a victimless crime. This is money that could fund hospitals, schools and job-creating infrastructure.

The end result is that when mega-millionaires and billionaires use these tax loopholes, it costs billions of dollars each year.

Tax avoidance is not a victimless crime. This is money that could fund hospitals, schools and job-creating infrastructure.